The AI Revolution: What Will Nvidia's Revenues and Profit Margins Be In 2028?

- Stu Rodnick

- Jun 19, 2024

- 6 min read

Updated: Jun 21, 2024

It's unofficially Nvidia week, the week in which Nvidia became the most valuable company in the world. Making this a good time to acknowledge what Nvidia has accomplished and the uniqueness of Jensen Huang, who has become a celebrity across the technology industry and finance world. As well, as look at a few future scenarios that will show how valuable of a company Nvidia may become by 2028.

Jensen Huang, The Entrepreneurial Genius of Elon Musk Without The Unnecessary Drama

While Jensen isn't a part of pop culture, in the same way Elon Musk is, that's a good thing for Nvidia.

As this talk at Stanford's Graduate School of Business shows, he is funny, smart and likable, without the extra(curricula) drama Elon creates outside of business. Nvidia and AI are his passions, and his life is anchored around these passions.

Jensen has become a hero to some. CEOs don't normally get asked to do things like this.

The Week Nvidia Became The World's Most Valuable Company

Markets are fascinating, and irrespective of any opinions on valuation, it's incredulous how quickly Nvidia has climbed in value.

"The stock rose 3.5 per cent to close at US$135.58 a share Tuesday, putting the company’s market value at about $3.3 trillion and catapulting it over those of Microsoft Corp. and Apple Inc. The top stocks have jockeyed all month for the pole position, with Nvidia finally edging past both of its big-tech peers." ~ Source: Bloomberg

As of June 18, 2024, Nvidia represents 7.27% of the S&P 500 Index.

What Will Nvidia's Revenue and Profit Margins Be In 2028?

Nobody knows the answer to this question. Just like nobody predicted in 2019 that Nvidia would become the world's largest valuable company in 2024.

Looking at a few scenarios for what's possible, requires taking a look at what drives Nvidia's valuation, revenue and profit margins (along with perceptions of future prospects).

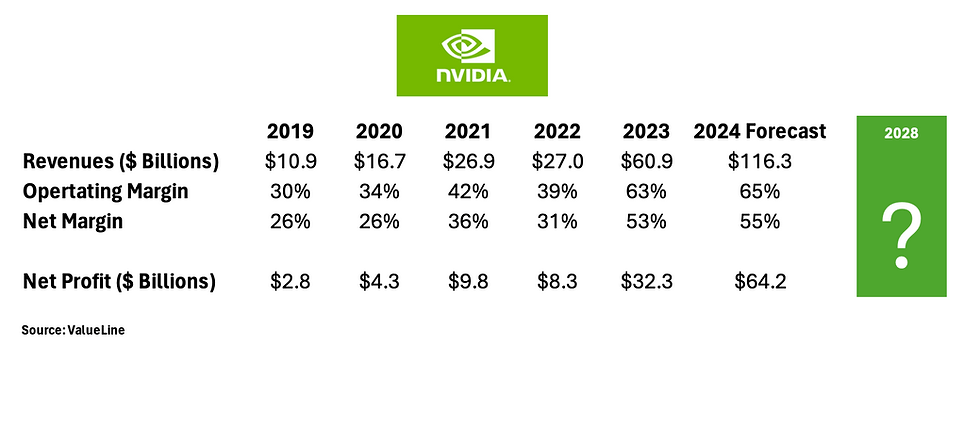

Nvidia's revenues went up 127% between 2022 and 2023 and could double again or come really close to doubling, between 2023 and 2024.

Nvidia has operating margins of 65% and net margins of 55%, which are both higher than even Microsoft's margins. Microsoft has long enjoyed profit margins that have been the envy of the technology world.

Microsoft's 2024 operating margins are forecasted to reach 48%, while net margins are forecasted to reach 34% in 2024.

Nvidia's 2028 Valuation Scenarios

In scenarios 1 - 3, Nvidia revenues triple between 2024 and 2028, while margins fluctuate between staying at 2024 levels, decreasing 25% and decreasing 50%

Scenario 1: Revenues Triple, Margins Stay At 2024 Levels

Revenues increase from $116 Billion in 2024 to $348 Billion in 2028

Operating margins remain 65%, Net Margins Remain 55%

Nvidia would generate $227 Billion in Operating Profits and $192 Billion in Net Profits in 2028 (increasing from a forecasted $64 Billion in 2024)

Scenario 2: Revenues Triple, Margins decrease 25%

Revenues increase from $116 Billion in 2024 to $348 Billion in 2028

Operating margins decrease to 48.8%, Net Margins decrease to 41.5%

Nvidia would generate $170 Billion in Operating Profits and $145 Billion in Net Profits in 2028 (increasing from a forecasted $64 Billion in 2024)

Scenario 3: Revenues Triple, Margins decrease 50%

Revenues increase from $116 Billion in 2024 to $348 Billion in 2028

Operating margins decrease to 32.5%, Net Margins decrease to 27.7%

Nvidia would generate $113 Billion in Operating Profits and $96 Billion in Net Profits in 2028 (increasing from a forecasted $64 Billion in 2024)

In scenarios 4 - 6, Nvidia revenues double between 2024 and 2028, margins fluctuate from staying at 2024 levels, decreasing 25% and decreasing 50%

Scenario 4: Revenues Double, Margins Stay At 2024 Levels

Revenues increase from $116 Billion in 2024 to $232 Billion in 2028

Operating margins remain 65%, Net Margins Remain 55%

Nvidia would generate $151 Billion in Operating Profits and $129 Billion in Net Profits in 2028 (increasing from a forecasted $64 Billion in 2024)

Scenario 5: Revenues Double, Margins Decrease 25%

Revenues increase from $116 Billion in 2024 to $232 Billion in 2028

Operating margins decrease to 48.8%, Net Margins decrease to 41.5%

Nvidia would generate $113 Billion in Operating Profits and $96 Billion in Net Profits in 2028 (increasing from a forecasted $64 Billion in 2024)

Scenario 6: Revenues Double, Margins Decrease 50%

Revenues increase from $116 Billion in 2024 to $232 Billion in 2028

Operating margins decrease to 32.5%, Net Margins decrease to 27.7%

Nvidia would generate $76 Billion in Operating Profits and $64 Billion in Net Profits in 2028 (flat compared to a forecasted $64 Billion in 2024)

Scenario 7: Revenues Quadruple, Margins Stay At 2024 Levels

Revenues increase from $116 Billion in 2024 to $465 Billion in 2028

Operating margins remain 65%, Net Margins Remain 55%

Nvidia would generate $302 Billion in Operating Profits and $257 Billion in Net Profits in 2028 (increasing from a forecasted $64 Billion in 2024)

Scenario 8: Revenues Quadruple, Margins decrease 25%

Revenues increase from $116 Billion in 2024 to $465 Billion in 2028

Operating margins decrease to 48.8%, Net Margins decrease to 41.5%

Nvidia would generate $227 Billion in Operating Profits and $193 Billion in Net Profits in 2028 (increasing from a forecasted $64 Billion in 2024)

Scenario 9: Revenues Quadruple, Margins Decrease 50%

Revenues increase from $116 Billion in 2024 to $465 Billion in 2028

Operating margins decrease to 32.5%, Net Margins decrease to 27.7%

Nvidia would generate $151 Billion in Operating Profits and $129 Billion in Net Profits in 2028 (increasing from a forecasted $64 Billion in 2024)

Which Way Will Nvidia Go In 2028?

As these scenarios demonstrate, Nvidia's valuation is anchored to maintaining profit margins, or revenues quadrupling from 2024 to 2028.

Margins Hold Steady, Revenue Doubles or Triples: If Nvidia's margins continue to hold steady into 2028, remaining significantly above Microsoft's (scenarios 1 and 4) and revenues double or triple between 2024 and 2028, Nvidia will grow into its valuation, as net profits can grow from an estimated $64 Billion in 2024 to $193 Billion in 2028 (assumes revenue triples between 2024 and 2028) or $129 Billion (assumes revenue doubles between 2024 and 2028)

Margins Decrease 25%, Revenue Triples: If Nvidia's margins decrease 25% by 2028, and revenues triple between 2024 and 2028 (scenario 2), Nvidia's valuation is likely to increase by 2028, as net profits will grow from an estimated $64 Billion in 2024 to $145 Billion in 2028.

Margins Decrease 25%, Revenue Doubles: If Nvidia's margins decrease 25%, and revenue doubles between 2024 and 2028 (scenario 5), net profits will increase from an estimated $64 Billion in 2024 to $96 Billion in 2028. In this scenario Nvidia's valuation is likely to decrease by 2028.

Margins Decrease 50%, Revenue Doubles or Triples: If Nvidia's margins decrease 50%, Nvidia's valuation will likely significantly decrease, even if revenues triple (scenario 3) or double (scenario 6), as net profits will grow from an estimated $64 Billion in 2024 to $97 Billion in 2028 (assumes revenue triples between 2024 and 2028) or net profits remains flat between 2024 and 2024 (assumes revenue doubles between 2024 and 2028)

Revenue Quadruples, Margins Remain at 2024 Levels, decrease 25% or decrease 50%: If Nvidia's revenue quadruples between 2024 and 2028 and margins hold steady, net profits will increase from an estimated $64 Billion in 2024 to $257 Billion in 2024 (scenario 7). If Nvidia's revenue quadruples between 2024 and 2028 and margins decrease 25%, net profits will increase from an estimated $64 Billion in 2024 to $193 Billion in 2024 (scenario 8). If Nvidia's revenues quadruple between 2024 and 2028 and margins decrease 50%, net profits will increase from an estimated $64 Billion in 2024 to $129 Billion in 2024 (scenario 9).

A bet on Nvidia today is either a bet on (1) Nvidia margins remaining at current levels or dropping to those of Microsoft, the gold standard in tech or (2) Nvidia's revenues quadrupling between 2024 and 2028.

Margins: While no one can predict Nvidia's margins over the next four years with certainty, investing in Nvidia is largely a wager on margins staying at the top to the tech industry.

Revenue Growth: Revenues are expected to continue growing throughout the decades, as it's still early days for the AI revolution. Albeit at a slower pace due to the company's increasing size and the law of larger numbers.

However, if Nvidia is somehow able to quadruple revenues (between 2024 and 2028), net profits will soar between 2024 and 2028, even if margins decrease 25% or 50%.

Watching how the tech industry reacts to Nvidia success will be a fascinating story for the duration of the decade.